2022 tax refund calculator with new child tax credit

This 2022 tax return and refund estimator provides you with detailed tax results. 24 when the IRS began accepting 2021 federal income tax returns.

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

It will be updated with 2023 tax year data as soon the data is available from the IRS.

. During the year adjust your W-4 and manage your paycheck based tax withholding. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Eligibility Rules for Claiming the 2021 Child Tax Credit on a 2021 Tax Return These FAQs were released to the public in Fact Sheet 2022 -28PDF April 27 2022.

The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6 years old. For 2022 Tax Estimates use this 2022 Tax Estimator. If your tax situation changes you can always come back to the calculator again.

If an estate exceeds that amount the tax rates range from 18 to 40. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. During the year adjust your W-4 and manage your paycheck based tax withholding.

Dare to Compare Now. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Of these 18 million required correction of errors.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. Discover Helpful Information And Resources On Taxes From AARP. The average refund was 2775 up from 2495 the year before an 112 jump.

2022 child tax credit calculator. Ad Know what your tax refund will be with FreeTaxUSAs free tax return calculator. If the total amount of your advance Child Tax Credit payments was greater than the Child Tax Credit amount that you may properly claim on your 2021 tax return you may have to repay the excess amount on your 2021 tax return during the 2022 tax filing season unless you qualify for repayment protection.

You claim this credit on Form 1040. Under the law known as the American Rescue Plan low- and middle-income parents can expect to receive 3000 for every child ages 6 to 17 and 3600 for every child under age 6. This calculator is integrated with a W-4 Form Tax.

Let Us Find The Credits Deductions You Deserve. Dont get TurboCharged or TurboTaxed. Estimate Your 2021 Child Tax Credit Advance Payments.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. This 2022 tax return and refund estimator provides you with detailed tax results during 2022. The IRS is no longer issuing these advance payments.

The latest round of federal stimulus was worth up to 1400 while the child tax. The credit will be fully refundable. The average direct deposit refund was 2851 up from 2592 the previous year.

Federal Estate TaxThere is also a federal estate tax that may apply but it has a much higher exemptionThe federal estate tax exemption is 1170 million for deaths in 2021 and 1206 million for deaths in 2022It is also portable. Business income of 1910000 and requesting a refund in the amount of 286600. The maximum child tax credit amount will decrease in 2022.

2022 tax refund calculator with new child tax credit By Date wimberley christmas market Category middletown nj police blotter september 2021 Jake Weber Net Worth 2020 Banksy Mona Lisa Meaning Banksy Mona Lisa Meaning Scottish Water Road Closures Albany County Police Blotter 2021 Sevi Wattpad Full Name Britannia Airways Fleet. For children under 6 the amount jumped to 3600. Apr 16 2022 The average refund.

3175Here are some last-minute tips on how to get a bigger tax refund including some special tax breaks that are new or expanded and good for only 2021 tax year returns due. The refund consisted of a New York State earned income credit in the amount of 188100 Empire State child credit in the amount of 54700 New York City earned income credit of 31300 and New York City school tax credit of 12500. Start Child Tax Credit Calculator.

Have been a US. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Also you need to take into account additional child tax credit and stimulus money into account.

The IRS is expected to give out 128 million refunds for the 2022 tax filing season for the 2021 tax year 31 percent higher than the previous year totaling 355 billion. A full chart of federal estate taxA yes supports authorizing the Florida State. Step 1 Run Your Numbers in the Tax Refund CalculatorEstimator.

By the end of 2022 get your personal refund anticipation date before you prepare and e-file. The sooner taxpayers gather their materials. 4 hours agoAs of July 29 the agency had 102 million unprocessed individual tax year 2021 returns.

You dont have to be 100 exact. Lip blush training miami. To be eligible for this rebate you must meet all of the following requirements.

Keep in mind its easy to claim the child. Once you have a better understanding how your 2022 taxes will work out plan accordingly. Once you have a better understanding how your 2022 taxes will work out plan accordingly.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The 2022 filing season formally opened on Jan. As you answer the questions you will see that the information you enter.

2022 child tax credit calculator. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age or younger.

Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. The majority of the time it is equal to the unused portion of the Child Tax Credit up to 15 of your earned income that is more than 3000. TurboTax Has Your Back.

By the end of 2022 and early 2023 get your personal refund anticipation date. The Additional Child Tax Credit is refundable which means you will receive the amount awarded in the form of a tax refund. You have to give a reasonable estimate.

Americans on average are receiving 3536 in tax refunds. Answer the simple questions the calculator asks. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. How much you get back on your tax return will depend on a few factors including your income and deductions.

Fy 2021 22 Or Ay 2022 23 New Income Tax Return E Filing Exemptions Deductions E Payment Refund Only 30 Second

Child Tax Credit In 2022 See If You Ll Be Paid 750 From Your State Cnet

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Income Tax Calculator Estimate Your Refund In Seconds For Free

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Simple Tax Refund Calculator Or Determine If You Ll Owe

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

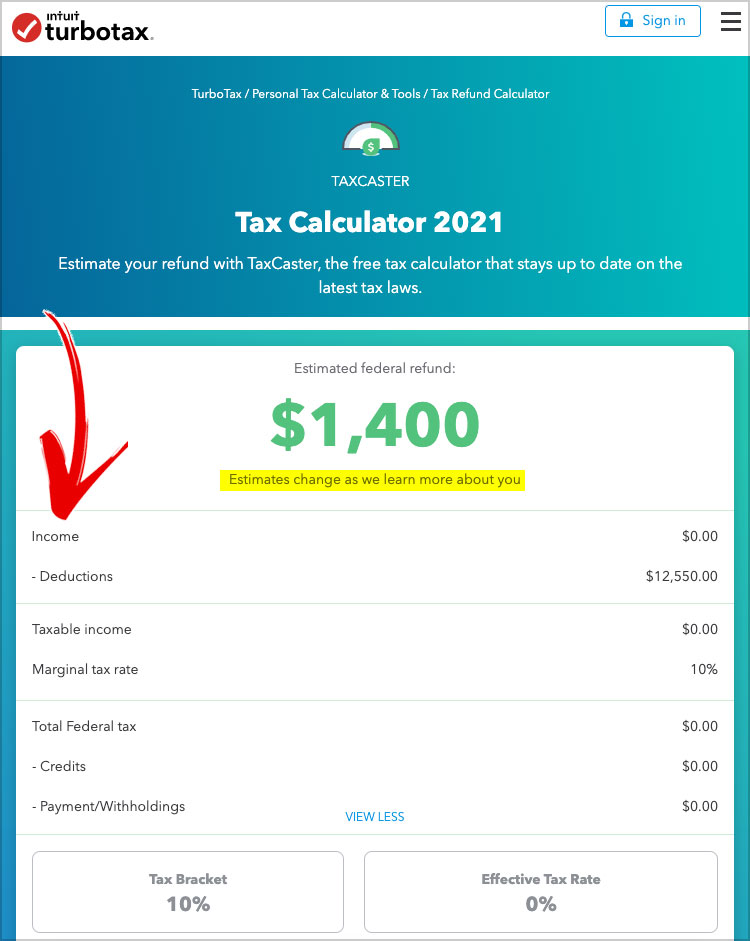

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

Fy 2021 22 Or Ay 2022 23 New Income Tax Return E Filing Exemptions Deductions E Payment Refund Only 30 Second

What Are Marriage Penalties And Bonuses Tax Policy Center